North Carolina Electric Car Tax

North Carolina Electric Car Tax. Please keep in mind that these may change at any time and certain conditions may. However, hybrid owners do not pay this amount.

Qualified electric vehicles, dedicated natural gas vehicles, and fuel cell electric vehicles may use north carolina hov lanes, regardless of the number of occupants. North carolina lawmakers are considering an electric vehicle highway use equalization tax.

Qualified Electric Vehicles, Dedicated Natural Gas Vehicles, And Fuel Cell Electric Vehicles May Use North Carolina Hov Lanes, Regardless Of The Number Of Occupants.

5 things to know about the future of electric cars in n.c.

In North Carolina And Many Other States, Qualified Evs May Use Hov Or Carpool Lanes,.

In january 2014, north carolina ev owners began paying an added annual fee of $100, which has since increased to $130.

If You’re Considering Buying An Ev In North Carolina Or Upgrading Your Home Infrastructure For.

Images References :

Source: e-vehicleinfo.com

Source: e-vehicleinfo.com

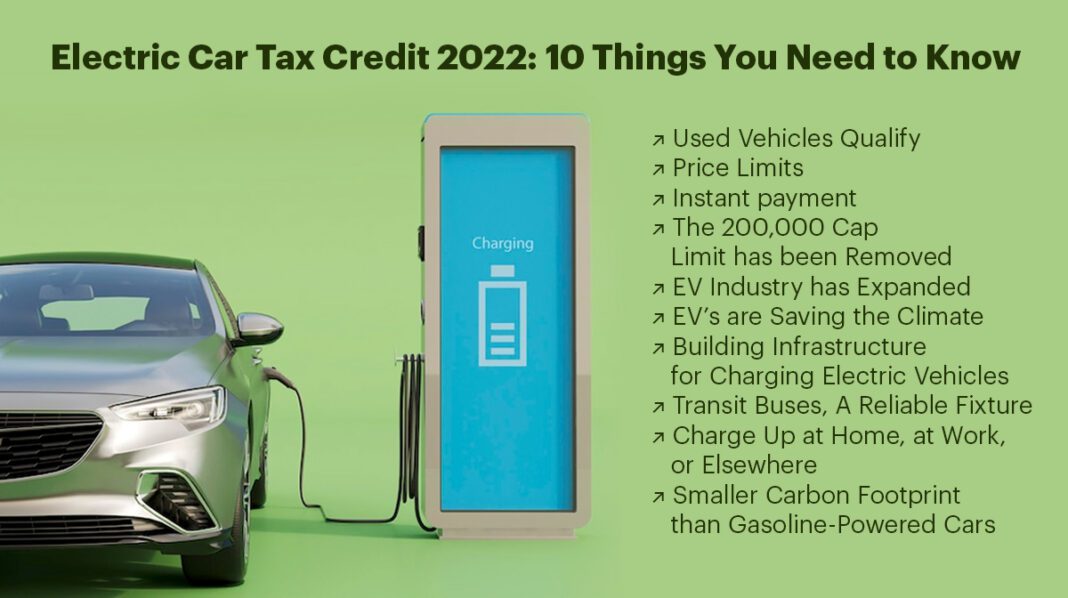

Electric Car Tax Credit 2022 10 Things You Need to Know EVehicleinfo, North carolina lawmakers are considering an electric vehicle highway use equalization tax. The goal is to have 1.25 million electric vehicles registered in north carolina.

Source: kbfinancialadvisors.com

Source: kbfinancialadvisors.com

Electric Vehicle Tax Credit What Qualifies & How to Save Money KB, Updated on apr 27, 2022. The fee’s presence has created a highly.

Source: www.fuelwhatmatters.org

Source: www.fuelwhatmatters.org

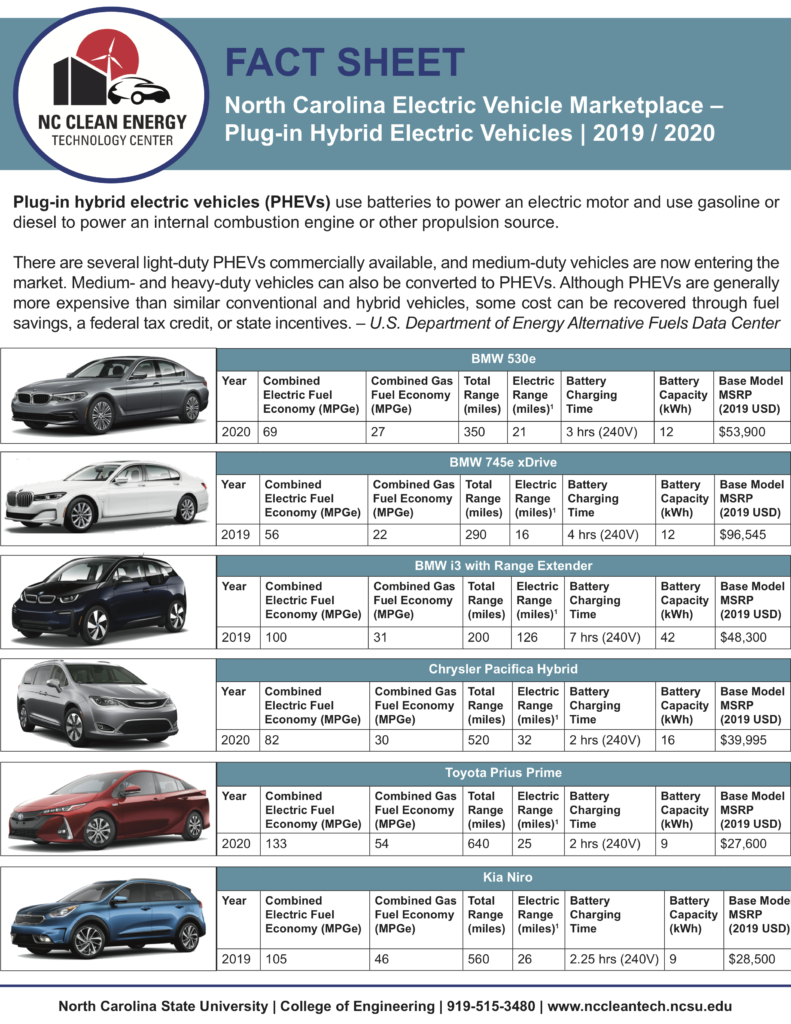

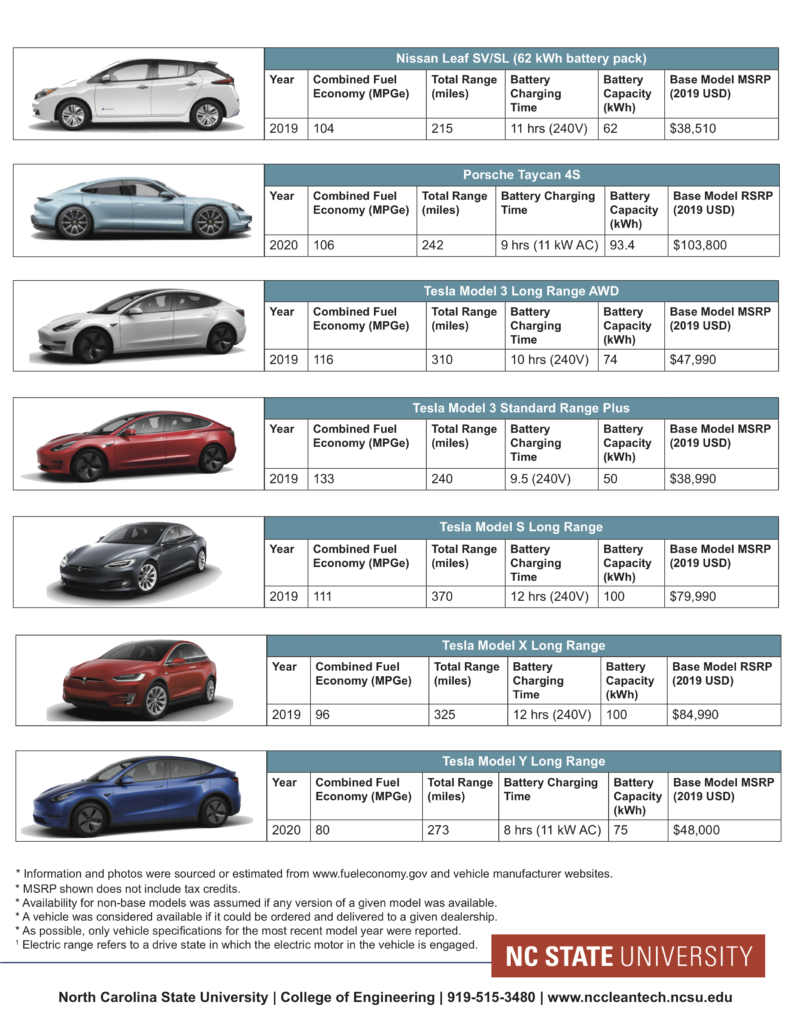

North Carolina Electric Vehicle Marketplace Fact Sheets Fuel What Matters, The goal is to have 1.25 million electric vehicles registered in north carolina. Check out the incentives we’ve found for the state of north carolina in 2023.

Source: elmersautobody.com

Source: elmersautobody.com

What You Need To Know About Electric Vehicle Tax Credits Elmer's Auto, In january 2014, north carolina ev owners began paying an added annual fee of $100, which has since increased to $130. The good news is that.

Source: getelectricvehicle.com

Source: getelectricvehicle.com

Electric Car Tax Credit Everything that You have to know! Get, Battery components and critical battery minerals. In january 2014, north carolina ev owners began paying an added annual fee of $100, which has since increased to $130.

Source: www.fuelwhatmatters.org

Source: www.fuelwhatmatters.org

North Carolina Electric Vehicle Marketplace Fact Sheets Fuel What Matters, In january 2014, north carolina ev owners began paying an added annual fee of $100, which has since increased to $130. 22, 2023 at 2:57 pm pdt.

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png) Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Electric Vehicle Tax Credit Amount Electric Vehicle Tax Credits What, The federal tax credit amount is $7,500; However, hybrid owners do not pay this amount.

Source: www.fuelwhatmatters.org

Source: www.fuelwhatmatters.org

Everything You Need to Know About Electric Vehicles & Electric Vehicle, Duke energy offers its residential. The goal is to have 1.25 million electric vehicles registered in north carolina.

Source: www.moveev.com

Source: www.moveev.com

Complete List of New Cars, Trucks & SUVs Qualifying For Federal, The good news is that. North carolina state law requires ev owners to pay.

Source: www.fuelwhatmatters.org

Source: www.fuelwhatmatters.org

North Carolina Electric Vehicle Marketplace Fact Sheets Fuel What Matters, Drivers who purchase and install an electric vehicle charging station can save over $500 with incentive programs. North carolina ev charger rebates.

The Maximum $7,500 Federal Ev Tax Credit Consists Of Two Equal Parts:

Charging, gas tax, public opinion:

22, 2023 At 2:57 Pm Pdt.

Check out the incentives we’ve found for the state of north carolina in 2023.